Protecting what matters most

We plan for holidays, home renovations, and retirement but we’re less likely to plan for the unexpected. Life insurance is one quiet but powerful way

We plan for holidays, home renovations, and retirement but we’re less likely to plan for the unexpected. Life insurance is one quiet but powerful way

Self-managed superannuation fund (SMSF) trustees always have a lot on their to-do lists but the first few months of 2026 are likely to be busier

A sudden death can place financial stress on those who depend on you. If this happens, life cover can help them pay the bills and

Investing may be all about the numbers – growth, returns and risk – to build a secure future but increasingly investors are interested in an

Few investment sectors combine geopolitical intrigue, technological innovation and long-term growth potential quite like rare earth elements (REEs). For Australians, the recent deal with the

Many investors breathed a sigh of relief at having survived (and even thrived) the turbulent economic and political events of 2025. Super funds posted strong

What role will an inheritance play in your long-term wealth strategy? If the ballpark numbers are at least remotely close, the amount of assets set

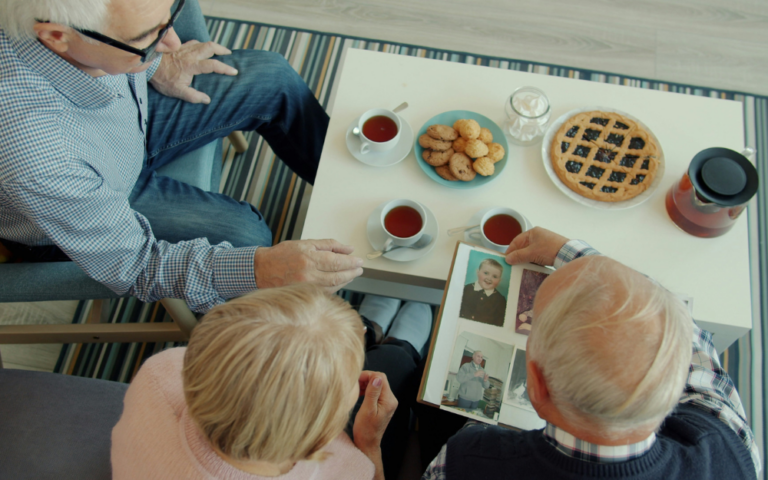

Ageing comes with wisdom, experience and a lifetime of stories, but it can also bring new challenges. Tasks that once felt effortless may now require

After a natural disaster, you may be targeted by ‘storm’ or ‘disaster’ chasers. They might claim to offer you quicker, cheaper, or specialised repair services,

It’s the season for gifts, sharing meals and spreading cheer. But what if your festive generosity could do more? What if it could ripple through

Men are earning on average A$9,753 more than women each year in the form of performance bonuses, allowances and overtime pay. That’s according to the

Retirement has often been seen as a time to slow down and enjoy the simple pleasures of daily life. And for many, that’s the dream.