Thinking about retirement

We can help you plan for retirement and meet financial challenges when you’re retired. You may be at a point in your life where you’re

We can help you plan for retirement and meet financial challenges when you’re retired. You may be at a point in your life where you’re

How to develop an estate planning strategy to deal with your assets in the event of your death. Estate planning involves developing a strategy to

It’s easy to get sucked into the lure of the biggest companies – they’re the most powerful; they’re unstoppable. But history suggests that’s not how

Planning to retire means considering the steps and decisions needed to get you to where you want to be. Think ahead to the kind of

Two mental traps that could be affecting your investing Even the most experienced investors can fall prey to subtle psychological traps. These behavioural biases often

Take a sec to check Scammers aim to take advantage of weak security and plan on you being distracted with everyday life. To keep yourself

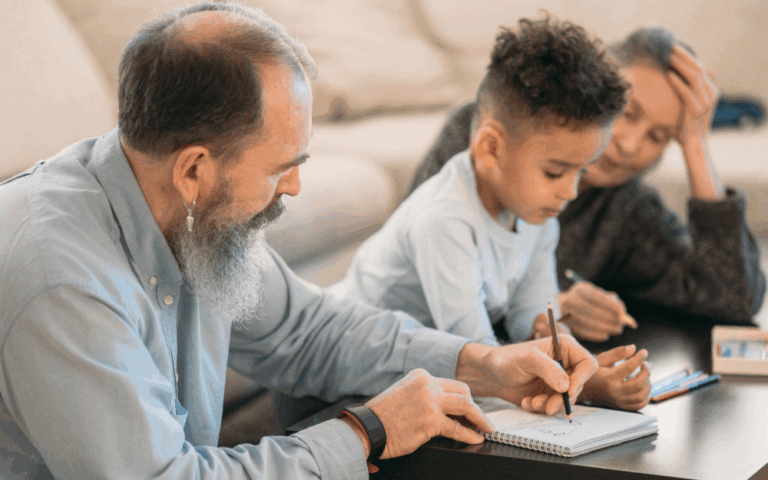

Money sure can stir up a lot of emotions in relationships. From arguments over who spent too much on takeout to disagreements about saving for

A simple ongoing investment strategy can deliver substantial returns over time Imagine planting a tree that not only grows fruit but also grows more branches,

What is a retirement village There are so many options when it comes to moving into a retirement village. Here we explain what some of

The bad news for savers relying on income returns is set to continue Australia’s underlying level of inflation is continuing to fall, and which paved

About SMSF investment restrictions SMSFs are complex, here we have outlined some of the restrictions to help you before you make any decisions on self-managed

The global rollercoaster ride of United States trade tariffs has now entered its latest phase. President Donald Trump’s April 2 “Liberation Day” announcement placed reciprocal